Looking for a loan?

Compare

Investment Home Loans

and

SMSF Loans

Home Property Tips

Property Tips

Getting Started

Why You Should Consider Refinancing Your Investment Property

Are you ready to invest in property?

Common mistakes first-time property investors make

Tips to diversify your real estate portfolio

Suburb reports are a property investor's best friend

Batten the hatches: How to ensure your property portfolio is recession ready

How do cash rate increases impact your investment loan?

Tips for property investors in 2023

2023 property resolutions for investors

Top 5 Considerations When Choosing a Hot Water System for Your Investment Property

Get the latest property investor news & expert insights delivered

By subscribing you agree to our privacy policy .

Latest Articles

Why You Should Consider Refinancing Your Investment Property

Are you ready to invest in property?

Common mistakes first-time property investors make

Tips to diversify your real estate portfolio

Suburb reports are a property investor's best friend

Batten the hatches: How to ensure your property portfolio is recession ready

How do cash rate increases impact your investment loan?

Tips for property investors in 2023

2023 property resolutions for investors

Top 5 Considerations When Choosing a Hot Water System for Your Investment Property

5 online tools tech-savvy investors should try

COVID not enough to deter Australian homebuyers

How this mistake can cost you thousands

Beating the dream crushers

It pays to be generous

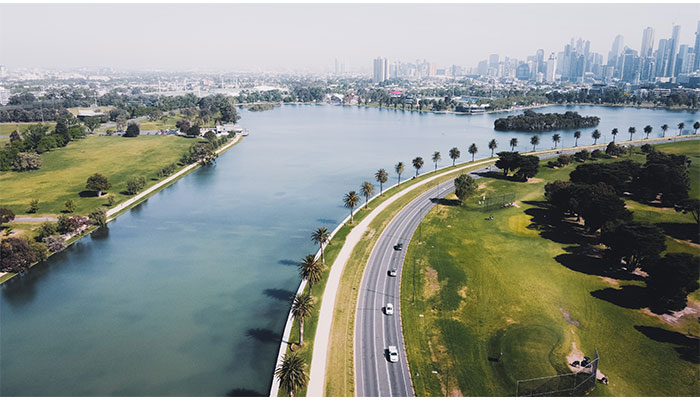

Why relocate your property portfolio?

Believing in a vision

Never forget your first

Property styling dos and don’ts

Settling down

Leading by example