Looking for a loan?

Compare

Investment Home Loans

and

SMSF Loans

Contributing Experts

John Lindeman

John Lindeman is widely respected as one of Australia's leading property market analysts, authors and commentators. Visit Lindeman Reports for more information. He has well over fifteen years’ experience researching the nature and dynamics of the housing market at major data analysts. John’s monthly column on housing market research featured in Australian Property Investor Magazine for over five years. He is a regular contributor to Your Investment Property Magazine and other property investment publications and e-newsletters such as Kevin Turners Real Estate Talk, Michael Yardney’s Property Update and Alan Kohler’s Eureka Report. John also authored the landmark books for property investors, Mastering the Australian Housing Market, and Unlocking the Property Market, both published by Wileys.

Latest Articles

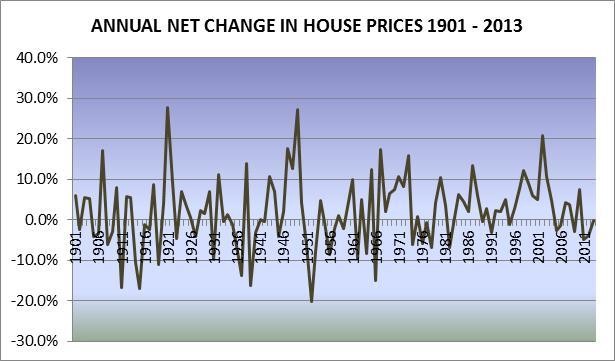

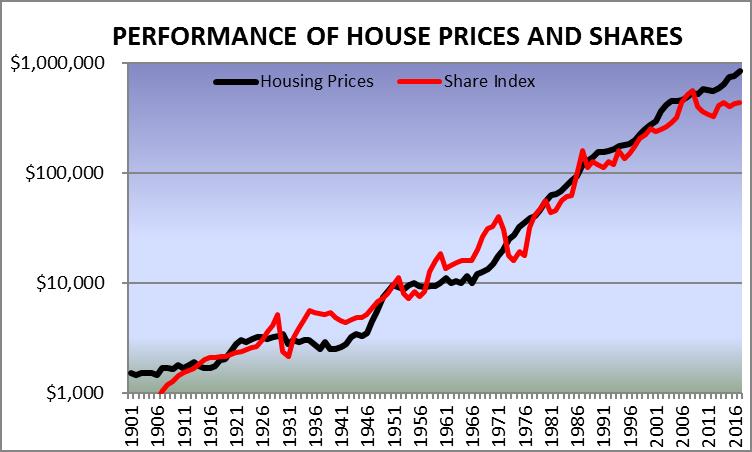

Time in the market

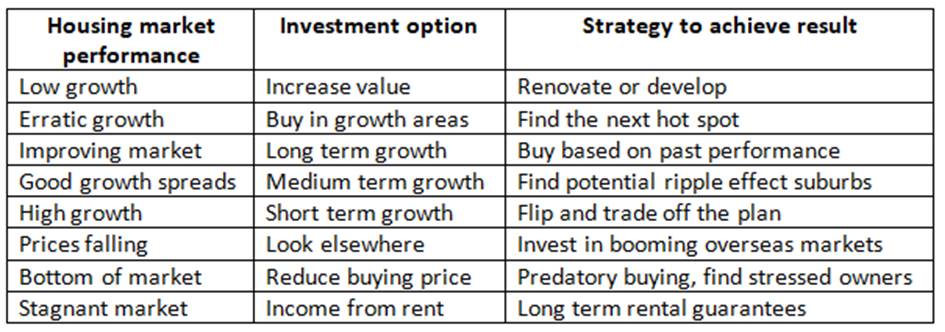

The property investment strategy cycle

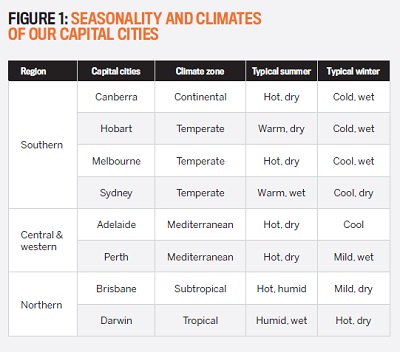

On the ground research

A bedtime story for housing investors

The Caterpillar and the Butterfly

The white wallabies of the property market

The Great Unoccupancy Rate

Buy with your heart or your head?

The Cryptocurrency Craze

Real Estate Myths

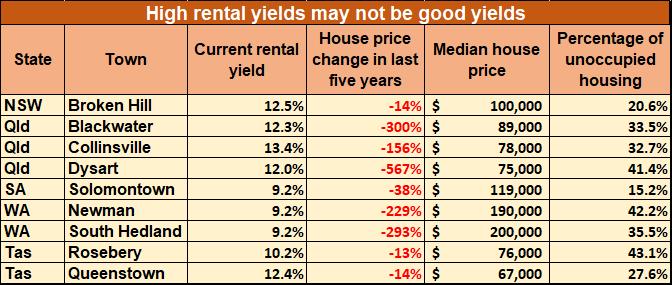

The truth about good yield and bad yield

Opportunities the Commonwealth Games may offer

The product pushers

How housing forecasters get it wrong

Why negative gearing is necessary

Can pets inherit property?

Beauty is in the eye of the beholder

Land on the Moon

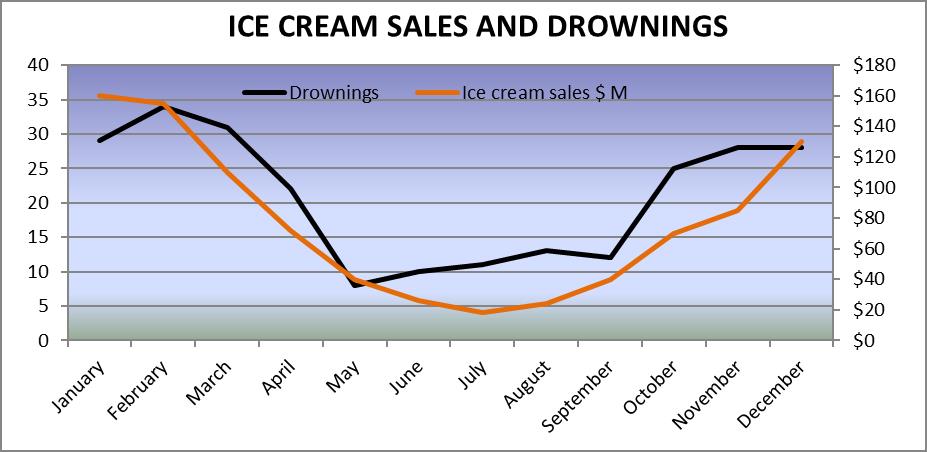

Footy fans and false correlations

The Ripple Effect

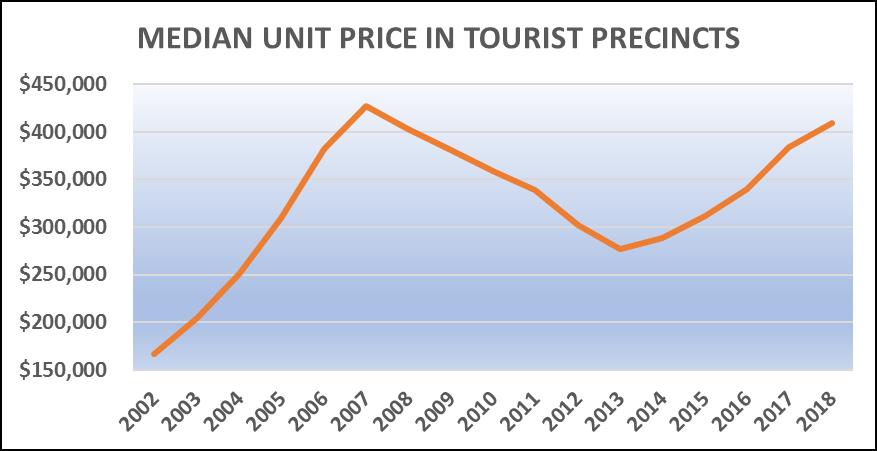

Discretionary buyer booms are coming