Looking for a loan?

Compare

Investment Home Loans

and

SMSF Loans

Home Property Finance

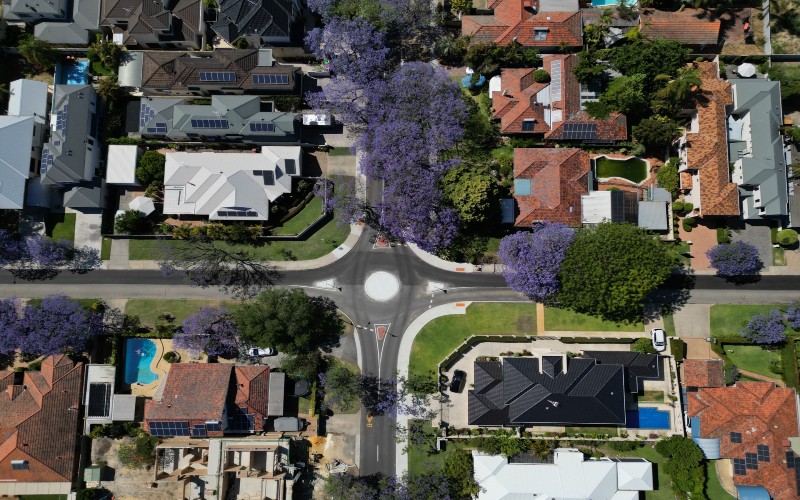

Property Finance

Getting Started

Buying Property Through Your SMSF? Avoid These 5 Critical Loan Mistakes

What to know about getting an investment loan with your SMSF

What to know before refinancing your investment property loan

Why you should consider a non-bank lender for your investment loan

Positive vs negative gearing explained

How to minimise your mortgage fees

What features should you look for in an investment loan?

What is the best loan type for an investment property?

Redraw vs offset: What’s the difference?

How to reduce your loan repayments in a rising rate environment

Get the latest property investor news & expert insights delivered

By subscribing you agree to our privacy policy .

Latest Articles

Buying Property Through Your SMSF? Avoid These 5 Critical Loan Mistakes

What to know about getting an investment loan with your SMSF

What to know before refinancing your investment property loan

Why you should consider a non-bank lender for your investment loan

Positive vs negative gearing explained

How to minimise your mortgage fees

What features should you look for in an investment loan?

What is the best loan type for an investment property?

Redraw vs offset: What’s the difference?

How to reduce your loan repayments in a rising rate environment

What is mortgage stress and how to avoid it

Is it a good idea to refinance when property prices are falling?

5 reasons to refinance your investment loan in 2023

What is mortgage stress & how to avoid it

How can investors prepare for rising interest rates?

Key reasons to refinance your investment loan in 2022

Can you get a discount for your energy-efficient investment property?

Is it worth it to refinance your SMSF?

Is now the time to fix your investment loan?

Is now the time to fix your investment loan?

Using Equity to Buy an Investment Property